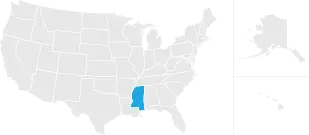

mississippi income tax calculator

The Mississippi tax tables here contain the various elements that are used in the Mississippi Tax Calculators Mississippi Salary Calculators and Mississippi Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. Only enter the amount received as a normal distribution.

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Mississippi Income Tax Calculator How To Use This Calculator You can use our free Mississippi income tax calculator to get a good estimate of what your tax liability will be come April.

. 2022 Mississippi state use tax. Box 23050 Jackson MS 39225-3050. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022.

Separation pay and deferred compensation plan distributions do. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA.

If you make 55000 a year living in the region of New York USA you will be taxed 12213. Now that all of Johns income has been taxed according to the states respective rates well add the results together to estimate what John owes the state of Mississippi in income taxes. Your average tax rate is 222 and your marginal tax rate is 361.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. To use our Mississippi Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Switch to Mississippi hourly calculator.

Ad Free Tax Calculator. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Mississippi Paycheck Calculator - SmartAsset SmartAssets Mississippi paycheck calculator shows your hourly and salary income after federal state and local taxes.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Mississippi Income Tax Calculator Find out how much your salary is after tax so you can have a better idea of what to expect when planning your budget 9 Ratings See values per. Ad Free For Simple Tax Returns Only.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Year Month Biweekly Week Day Hour Results Salary Before Tax 0 Salary After Tax 0 Total Tax 0 Average Tax Rate 0 US Dollar 0 Net Pay 0 Total Tax. Mississippis SUI rates range from 0 to 54.

Create Your Account Today to Get Started. All other income tax returns P. File your Mississippi and Federal tax returns online with TurboTax in minutes.

Information on Available Tax Credits. Now lets say John marries Mary who has a taxable income rate of 20000. Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup screen.

The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS. The MS use tax only applies to certain purchases. The taxable wage base in 2022 is 14000 for each employee.

Mississippi allows for a subtraction of retirement income on the state return. You can choose an alternate State Tax Calculator below. Mississippi Income Tax Calculator - SmartAsset Find out how much youll pay in Mississippi state income taxes given your annual income.

Income Tax Calculator 2021 Mississippi 206000 Mississippi Income Tax Calculator 2021 If you make 206000 a year living in the region of Mississippi USA. This Mississippi hourly paycheck calculator is perfect for those who are paid on an hourly basis. Customize using your filing status deductions exemptions and more.

TurboTax Is Designed To Help You Get Your Taxes Done. See What Credits and Deductions Apply to You. Please make sure you select the correct Pay Period there.

Enter your info to see your take home pay. File Now with TurboTax 20 22 Income Tax Estimator. Early or Excess distributions do not qualify for this subtraction.

State Date State Mississippi. Change state Check Date General Gross Pay. Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA you will be taxed 15202.

Mississippi Income Tax Calculator eFile your Mississippi tax return now eFiling is easier faster and safer than filling out paper tax forms. Enter Your Tax Information. The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in Mississippi.

That means that your net pay will be 42787 per year or 3566 per month. Your average tax rate is. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi paycheck calculator.

The Mississippi use tax should be paid for items bought tax-free over the. 0 120 200 650 970 Johns total state tax liability is 970. The Mississippi use tax is a special excise tax assessed on property purchased for use in Mississippi in a jurisdiction where a lower or no sales tax was collected on the purchase.

On the next page you will be able to add more details like itemized deductions tax. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Click image to enlarge Set up company tax information option.

Get Your Maximum Refund When You E-File With TurboTax. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. Mississippi Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Income Tax Calculator Estimate Your Refund In Seconds For Free

Llc Tax Calculator Definitive Small Business Tax Estimator

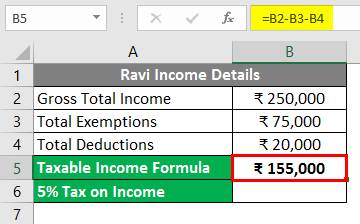

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

North Carolina Income Tax Rate And Brackets 2019

Mississippi Income Tax Calculator Smartasset

How To Create An Income Tax Calculator In Excel Youtube

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

Car Tax By State Usa Manual Car Sales Tax Calculator

Mississippi Sales Tax Small Business Guide Truic

Tax Rates Exemptions Deductions Dor

Mississippi Income Tax Brackets 2020

Tax Withholding For Pensions And Social Security Sensible Money

Where S My State Refund Track Your Refund In Every State

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Mississippi Income Tax Calculator Smartasset